COVID stimulus funds led to a drop in debt spending

The Financial Health Network published its 10th yearbook Expense Reportshowing the first general decline in interest and fee expenses.

The study follows US household spending on financial services during the pandemic, arguing that the 4% drop in debt spending is due to the student loan debt moratorium, government stimulus and a pandemic-driven decline in credit card debt.

Still, analysts said underserved populations are paying a larger chunk of fees and spending is likely to rise as pandemic pressures ease this year.

“The last two years of the pandemic have been a roller coaster ride for people financially, often forcing them to recalibrate their lives and finances with each new COVID development,” said Jennifer Tescher, CEO of the Financial Health Network.

“While we have seen a rare decline in overall financial services spending in 2021, the confluence of increased consumer spending, the end of government aid and rising inflation points to an increase in fees and interest rates for 2022; this will likely fall disproportionately on households that are already financially distressed.”

Decline in spending will not last

Analysis of annual trends for more than two dozen financial products and services revealed a rare drop in overall spending. However, an outsized cost burden remains for underserved populations, which is a concern given an expected increase over the coming year.

Total interest and fees declined 4% to $305 billion from a 2020 peak of $319 billion, mostly due to changes in credit card and student loan spending. This year’s report found that households considered “financially unhealthy” accounted for 83% of all fees and interest paid:

| product | Total fees in B 2020 |

Total in B 2021 |

% change |

|---|---|---|---|

| Account Maintenance Fees | $5.0 | $4.8 | -4% |

| ATM fees | $2.0 | $2.3 | +15% |

| Check cashing, non-bank | $1.6 | $1.5 | -3% |

| International transfers | $8.5 | $8.9 | +5% |

| money orders | $0.9 | $0.9 | +2% |

| Overdraft/NSF | $11.4 | $10.7 | -6% |

| Cards with credit | $6.2 | $7.2 | +17% |

| TOTAL | $35.4 | $36.4 | +3% |

Despite declining overall spending, households with fewer benefits continued to tend to borrow more expensively and service more expensive interest rates.

When broken down by income, race and ethnicity, differences become clear. As a percentage of their income, black households spent an average of 7% on fees, twice as much as white households spent on 3% interest, while Latinx families spent 5% or 40% more than white households.

Low- to middle-income households spent 8% of their income on fees and interest, more than double that of higher-income brackets, who paid 3%.

The expenses differed according to the product type: BNPL

Following the BNPL rush that began in August, Financial Health Network saw a significant surge in the BNPL market. As of March 2022, consumers were paying an estimated $1 billion in total interest on popular pay-in-four or other BNPL options.

By comparison, they estimated that by 2021, households will carry a total balance of $95 billion in interest and fees on cards.

The Financial Health Network has found that BNPL users are disproportionately those struggling with their financial health.

Based on their March BNPL specific briefing, one in four users of BNPL was financially vulnerable. The Financial Health Network Score describes vulnerable populations who are struggling with most or all aspects of their financial lives: almost a quarter report having difficulties making payments.

The study also found that younger generations like Gen Z are looking for tech-friendly alternatives to credit cards: 20% of 18-25 year olds surveyed said they had used BNPL in the past 12 months.

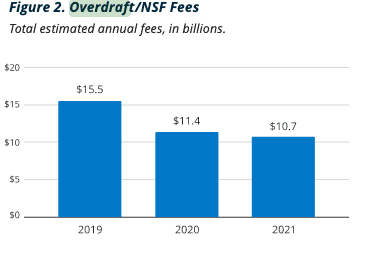

overdraft

Overdraft and underfunding fees appear to have leveled off, totaling around $11 billion in 2020 and 2021. Recent announcements by analysts regarding overdraft reforms by several major banks could lead to positive changes in this market in 2022.

Bank of America, for example, announced it would lower its fee to $10 on May 1. Chase lowered her fee to $34, just below Wells Fargo and TD Bank’s $35 and PNC’s $36.

Meanwhile, many digital banks have cut fees altogether, such as Ally, Axos, Chime, Monzo, and Revolut.

The Financial Health Network found that black households with bank accounts were nearly twice as likely to report having paid at least one overdraft fee as white households, while Hispanic households were 1.5 times more likely to report it.

Financially vulnerable households with bank accounts were about 10 times more likely to pay overdraft fees.

Bad news: Credit card debt is back

The pandemic was heralded as a dramatic shift in US credit card debt, and the trend continued throughout 2021 until the final quarter, when repayments saw a record jump.

From the February 2020 lockdown to June this year, the WSJ found that U.S. borrowing debt fell 10% as customers stayed indoors and saved.

Debt relief, pandemic stimulus, and deferred mortgages and student loans fed directly into credit card repayments, down 10% in 2021, but only for a while. The surprise last quarter set a red flag for financial health, closer to pre-pandemic levels, according to the Financial Health Network.

Based on New York Fed Center for Macroeconomic Data Released in February 2022, this was the most significant increase in aggregate household debt since 2007.

“Overall credit card limits were increased by $96 billion in the fourth quarter, and overall credit limits are now $160 billion above pre-pandemic levels,” the Fed study noted. “Total credit card account limits are now $4.06 trillion compared to $3.93 trillion in Q1 2020.”

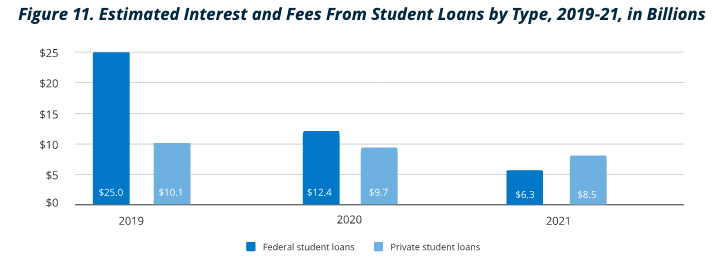

student loans

Federal student loan interest and fees fell precipitously from an estimated $25 billion in 2019 to $6.3 billion in 2021 due to the March 2020 moratorium. Unfortunately, the suspension for student loans ends on August 31, 2022.

For each month that the moratorium is extended, the study estimates that federal student loan borrowers will save $1.5 billion in interest payments. State student loans account for 92% of the $1.7 trillion total; private student borrowers paid 30% more interest and fees than government student borrowers in 2021.

The good news: pawn, payday, and title loans are falling

Financial Health Network found that interest rates and fees for alternative financial services fell dramatically between 2019 and 2021: deposit receipts fell 25%, payday fell 45%, and title loans fell nearly 40%.

Payday loans, in particular, have seen a significant decline over the past year, with the percentage of households reporting usage falling from 5% in 2020 to 3% in 2021.

Black households, low- to middle-income households, and financially vulnerable households all reported significant decreases in payday loan utilization.

“One of the reasons we’re partnering with the Financial Health Network is to continue assessing how households have managed their finances during the pandemic,” said Sarah Keh, VP of Inclusive Solutions at Prudential.

“Access to quality, affordable financial services—particularly across race, ethnicity, and income—provides data for researchers, policymakers, and advocates to track trends and identify opportunities to support more equitable financial health policies and products.”

year in review

As 2021 drew to a close, spending across multiple products returned to pre-pandemic median levels. Credit card balances fell dramatically but rebounded in time for holiday spending. Installment loan balances rose in the second half of 2021, as did current account fees.

The report found that out; “If household spending continues to rise, interest rates rise as expected, and remaining government support expires as forecast, we expect 2022 to see overall interest rates and fees for financial services rise. Households with financial difficulties are likely to feel this impact the most.”

methodology

It’s the Spending Report’s ten-year review, but the second following a new methodology that matches the research to a nationally representative survey of consumer spending. The survey of more than 5,000 US resident adults went out in November 2021.

Finally, the Financial Health Network said that in 2022 it will be working on briefs that “take a closer look at products with particular impacts on policymakers, financial services providers and financial health in general.”

- About the author

- Latest posts

Extremely energetic news reporter, asking questions about the collision between Silicon Valley, Wall Street and everywhere in between. Studied history at the University of Delaware, learned to write at the Verificationand debanked. Email [email protected] with story ideas, questions, or to say hello.